A couple of years ago, I had never heard of electronic scooters (e-scooters) or of Lime. But in June 2018, Lime launched its e-scooters in Paris, and passed 1 million rides in the city in just a few months (Lime, 2018). My friends and I were all enjoying this new, convenient, agreeable and fun way to travel small distances. In this blog post, I then wanted to look at Lime’s business model in greater detail, to evaluate how it succeeded in cracking the market in just a few months, and in transforming the way urban citizens experience micromobility.

A dazzling success worldwide

Lime is a US based company, founded in San Francisco in 2017. The company first started with a e-bike service, before launching e-scooters to complete its product portfolio (Lelièvre, 2019). From the very start, Lime detected urban dwellers’ need for a cheap, convenient and flexible way to travel short distances quickly in highly congested cities (Boston Consulting Group, 2019).

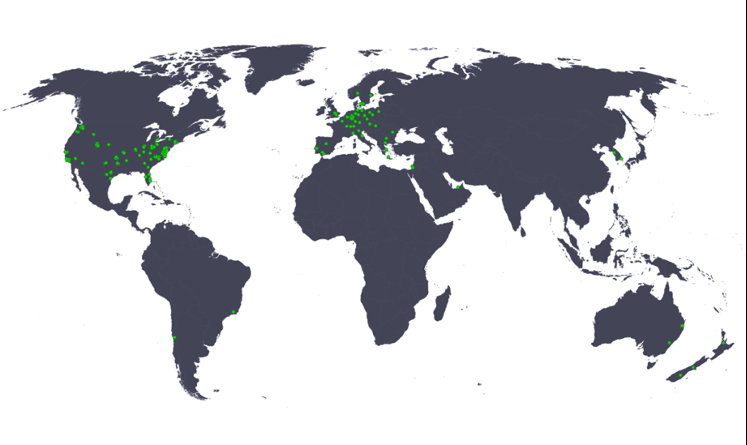

Lime’s success soon followed, and, in September 2019, the company exceeded 100 million rides (Somerville, 2019). It is now the world leader of the e-scooters market with a market valuation of over $2 billion and investors such as Uber or Alphabet – Google’s parent company (Future Engine, 2018; Lelièvre, 2019; BCG, 2019). Lime’s e-scooters can be found in more that 100 cities worldwide including London and Milton Keynes in the UK (Lime, 2020e). Its main competitor, Bird, has also registered major growth rates (Future Engine, 2018).

Simply unlock and ride – a convenient offer allowed by new technologies

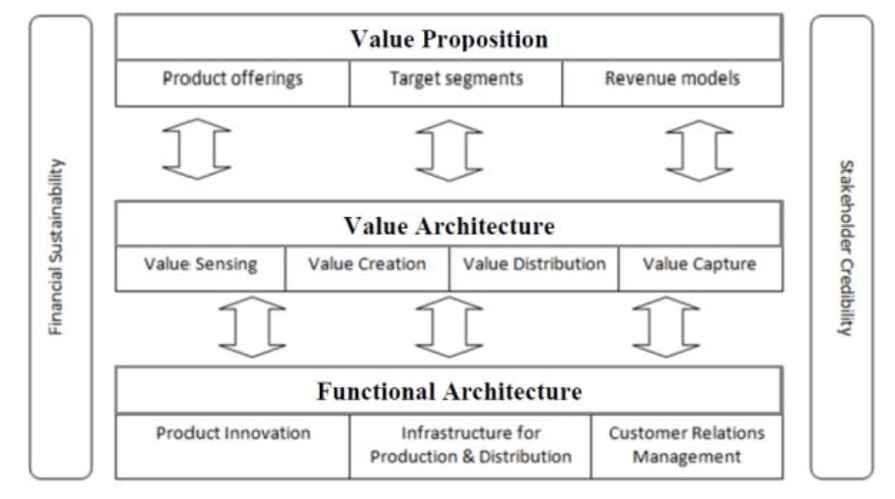

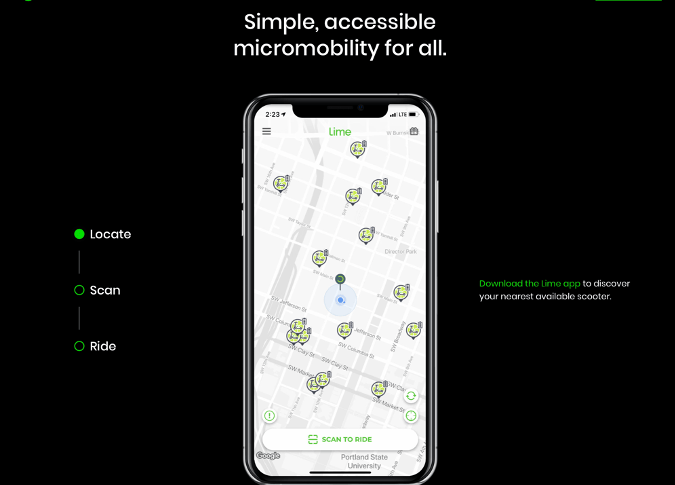

If Lime’s appeal can be explained by the ease of use and convenience of its offer, it would not have been successful without integrating technological innovations in its business model. Lime relies on an on-demand business model: users can access vehicles whenever they need, for a short-term rental, thanks to a digital platform (FourWeekMba, 2020). Li’s business model framework (2018), allows to observe in greater detail the pervasiveness of digital technologies within Lime’s entire business model (Figure 3).

First, Lime’s value proposition and more specifically its product offering and revenue model are heavily reliant on digital. Indeed, once the user has downloaded Lime’s app, he or she can just geolocate the closer e-scooter thanks to an interactive map. Then, the e-scooter can be unlocked simply by scanning a QR code, and the user can start riding. When the ride is over, the scooter can be parked wherever it is authorized and can be locked again using the app. Payment is also made on the app: a fixed rate is charged to unlock the vehicle and a fee per minute is applied depending on the city, time of day and day of the week (Lime, 2020a).

The value architecture is then transformed as well by new mobile and payment technologies, allowing the company to implement a dynamic pricing strategy (SmartInsights, 2014). Finally, Lime’s functional architecture is also based on mobile technologies. More specifically, the company employs “juicers” to recharge the e-scooters, ensuring service continuity. Juicers are part-time workers, paid depending on the number of scooters they charge (Lime, 2020a). Lime is therefore also part of the growing gig economy, offering jobs to independent contractors (Petriglieri et al., 2018).

Will the success last?

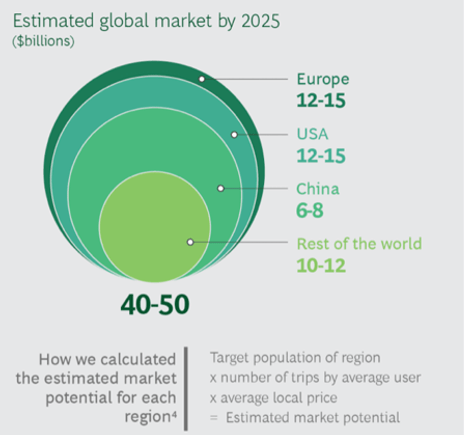

Despite its impressive growth, one can wonder whether the company is here to stay. Indeed, recent difficulties have questioned the financial sustainability of Lime’s business model (Li, 2018). Indeed, even if it theoretically takes four months for a e-scooter company to break-even, scooters are sometimes stolen or vandalized, and can be damaged by weather conditions (BCG, 2019; McKinsey & Company, 2019). This has generated important costs for Lime, threatening its profitability. Rates of adoption have also been slower than predicted in some markets, forcing Lime to announce withdrawal from 12 cities at the beginning of the year (Lime, 2020d) In addition, the proliferation of scooters in some cities, and the security risks associated, have led many cities to try to regulate and to limit e-scooters usage (BCG, 2019). With an ever increasing global e-scooter market, which is forecasted to reach $40 to $50 billion worldwide in 2025, new entrants are appearing, making the competition even fiercer (BCG, 2019). As a result, Lime’s market position may be challenged and the company may have to differentiate its offer and to refine its current business model to stay competitive.

Lime could thus rely on further technological developments to offer more resistant and performant scooters, with longer lasting batteries in order to be more profitable (BCG, 2019). Second, a sidewalk riding detection tool is currently beta-tested in San Jose, California, and could be more widely implemented, in an effort to tackle urban securities issues (Lime, 2020b). Finally, Lime is now partnering with Uber, taking advantage of digital tools to access new value creation channels (Lime, 2020c).

Lime’s e-scooters are therefore an example of how digital can make a company successful by providing consumers with an innovative value proposition. It however also illustrates that these new business models may experience difficulties to be financially sustainable. As many digital companies, Lime then may have to keep adapting and to keep seizing digital opportunities and innovations, to remain the market leader.

References

Boston Consulting Group. (2019). The Promise and Pitfalls of E-Scooter Sharing. Retrieved March 4, 2019 from https://www.bcg.com/fr-fr/publications/2019/promise-pitfalls-e-scooter-sharing.aspx?fbclid=IwAR1nLYzlfyAF54oNhPej9CHWbS1jR0vV2IeNm5TePRTG1CB03ovozuqKmwo&redir=true

FourWeekMBA. (2020). Digital Business Models Map: The Most Popular Digital Business Model Types. Retrieved March 5, 2020 from https://fourweekmba.com/digital-business-models/#On-demand_model

Future Engine (2018). Lime and Bird worth $10B+ each or 5x to 10x more than their last valuations. Retrieved March 3, 2020 from https://www.futureengine.org/articles/scooters-are-worth-10b

Lelièvre, A. (2019, February 28). Lime, la trottinette milliardaire. Les Echos. Retrieved from https://www.lesechos.fr/industrie-services/tourisme-transport/lime-la-trottinette-milliardaire-994622

Li, F. (2018). The digital transformation of business models in the creative industries: A holistic framework and emerging trends. Technovation, 102012. doi: https://doi.org/10.1016/j.technovation.2017.12.004

Lime (2018). Year-End Report. Retrieved from https://www.li.me/hubfs/Lime_Year-End%20Report_2018.pdf

Lime (2020a). Home. Retrieved March 3, 2020 from https://www.li.me/en-us/home

Lime (2020b). Lime Debuts Sidewalk Detection As Their Latest Innovation To Improve Scooters for All. Retrieved March 4, 2020 from https://www.li.me/second-street/lime-debuts-sidewalk-detection-latest-innovation-to-improve-scooters-for-all

Lime (2020c). Smart Urban Mobility Whenever You Need It. Retrieved March 3, 2020 from https://www.li.me/lime-uber-electric-scooter

Lime (2020d). The Path Forward at Lime. Retrieved March 5, 2020 from https://www.li.me/second-street/the-path-forward-at-lime

Lime (2020e). Locations. Retrieved March 3, 2020 from https://www.li.me/locations.

McKinsey & Company (2019). Micromobility’s 15,000-mile checkup. Retrieved March 4, 2019 from https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/micromobilitys-15000-mile-checkup

Petriglieri, G., Ashford, S. and Wrzesniewski, A. (2018). Thriving in the Gig Economy. Harvard Business Review, 96(2), 140-143.

SmartInsights. (2014). An introduction to dynamic pricing for Commerce. Retrieved March 5, 2020 from https://www.smartinsights.com/digital-marketing-strategy/online-marketing-mix/dynamic-pricing-ecommerce/

Somerville, H. (2019, November 26). Silicon Valley Adjusts to New Reality as $100 Billion Evaporates. The Wall Street Journal. Retrieved from https://www.wsj.com/articles/silicon-valley-adjusts-to-new-reality-as-100-billion-evaporates-11574764205?mod=hp_lead_pos5

Hi, Nolwenn. I think your blog is really close to our life. In China, we also have a similar electrical bicycle company named Ofo, but it is on the verge of closure. When it first came out to take shared bicycle service, it developed fast in China and all most every county has it. It is also convenient for people’s life. However, with its large-scale development, the cost pressure beginning to increase since a large number of bicycles needed to be maintained and some of them were vandalized. The company could not withstand such large capital pressure. So, changing the business target to use second-hand bicycles for development may reduce capital pressure. Maybe it is a common problem for most shared economy company, so does Lime e-scooters.

J’aimeJ’aime

Hi Nolwenn, thanks for bringing new light for the digital business model by Lime e-scooters. Lime e-scooters are a typical example of convenience that can be enabled through a digital transformation where they have an in-built application which can be utilised by the users and they serve to be the typical choice for customers who require a cheap mode of transportation. There is absolutely no doubt that the electronic vehicle market is steadily increasing. However, on the other end, one of the significance of utilising these kinds of vehicles is to get rid of pollution, rapid utilisation of these vehicles can once again trouble the cities causing pollution. As with the report by Belga News Agency, it has been revealed that electric scooters produce about 131 gm of carbon dioxide per kilometre and further it has also been estimated Brussels has the maximum number of e-scooters from Lime (The Brussels Times, 2020). Hence, Lime should also concentrate on resolving these kinds of issues to capture more value from its customers.

Source :

https://www.brusselstimes.com/all-news/business/99610/do-shared-e-scooters-pollute-more-than-cars-in-brussels/

J’aimeJ’aime

Wow, a really informative post! Before today, I had never heard of Lime. I can definitely see Lime being popular with millennials that want both budget and environmentally friendly means of transport. I do wonder how popular lime would be with older markets – perhaps it would be unsuitable for the grey market in case of injury, or business professionals desperate for social desirability who fear stepping outside of their box.

You mentioned various reasons that Lime’s success may dwindle – the coronavirus pandemic is also likely to contribute any financial difficulties. Quarantine measures in the UK and various other countries are becoming stricter, whilst people are becoming more self-isolationist and cautious. Therefore, sharing e-scooters may not be on the top of anyone’s to do list!

J’aimeJ’aime